If you live in the state of Michigan, personal injury protection, or “PIP” coverage for your auto insurance policy has become a hot topic. PIP stands for personal injury protection. It covers costs associated with personal injury after an auto accident. But that leaves many people wondering, wouldn’t my health insurance cover my hospital bills? Why would I need PIP coverage if I already have health insurance? How is PIP coverage different than health insurance?

Difference Between PIP Coverage and Health Insurance

At first glance, PIP medical coverage may seem insignificant if you already have a health insurance plan. But in the event of an auto accident, PIP covers a lot more than a health insurance plan will. Health insurance plans will typically help cover the cost of hospital bills, doctor appointments, and prescriptions all subject to deductibles and copays. On the other hand, with PIP coverage you are not subject to copays, co-insurance, and health insurance deductibles. In addition, PIP covers expenses for medical care, recovery, rehabilitation, wage loss, and even some funeral expenses.

For example, if you were paralyzed in an auto accident, PIP will pay for physical therapy, attendant care, etc. If you have unlimited PIP coverage, it will pay these expenses for life if need be. On the contrary, without PIP you would rack up thousands of dollars in copays, deductibles, rehabilitation expenses, etc. Or even worse, you cannot afford to pay for it and don’t get the care you need.

How Much Does PIP Medical Coverage Cost?

The good news is that it doesn’t cost very much to add PIP to your auto insurance plan. On average, unlimited PIP coverage will only be about an extra couple hundred dollars per year. To put that into perspective, that’s only $16.67 a month to be insured for life in the event that you’re hurt in an accident. That’s about the same amount you are most likely paying for other subscriptions like Hulu or Amazon Prime. Although professionals recommend unlimited PIP, there are cheaper coverage plans as well.

Types of PIP Medical Coverage

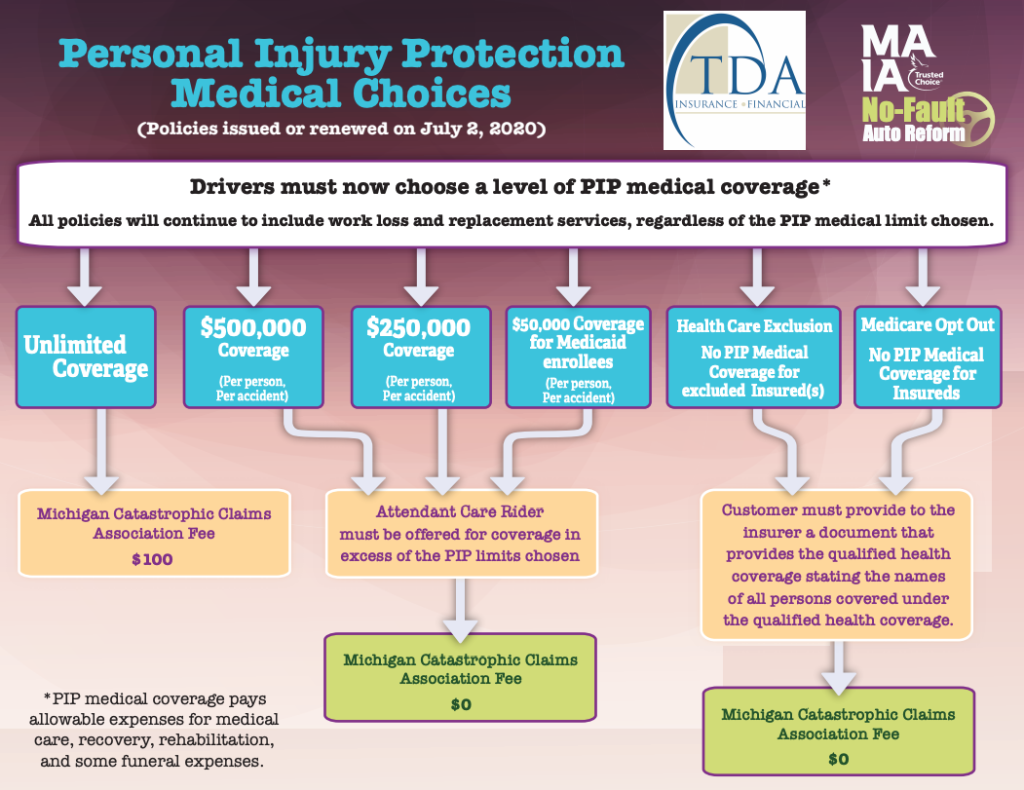

There are a couple of different types of PIP medical coverage that you can choose from. If you are not choosing unlimited PIP coverage, you can choose PIP up to a specific dollar amount for a lesser price. Once you reach that dollar amount, you are no longer covered through your auto insurance. In Michigan, your choices are:

- Unlimited coverage (infinite coverage)

- $500,000 coverage (per person, per accident)

- $250,000 coverage (per person, per accident)

- $50,000 coverage for Medicaid enrollees (per accident, per person)

- Opt out of PIP (with qualified health insurance plan provided)

- Opt out of PIP (with Medicare coverage provided)

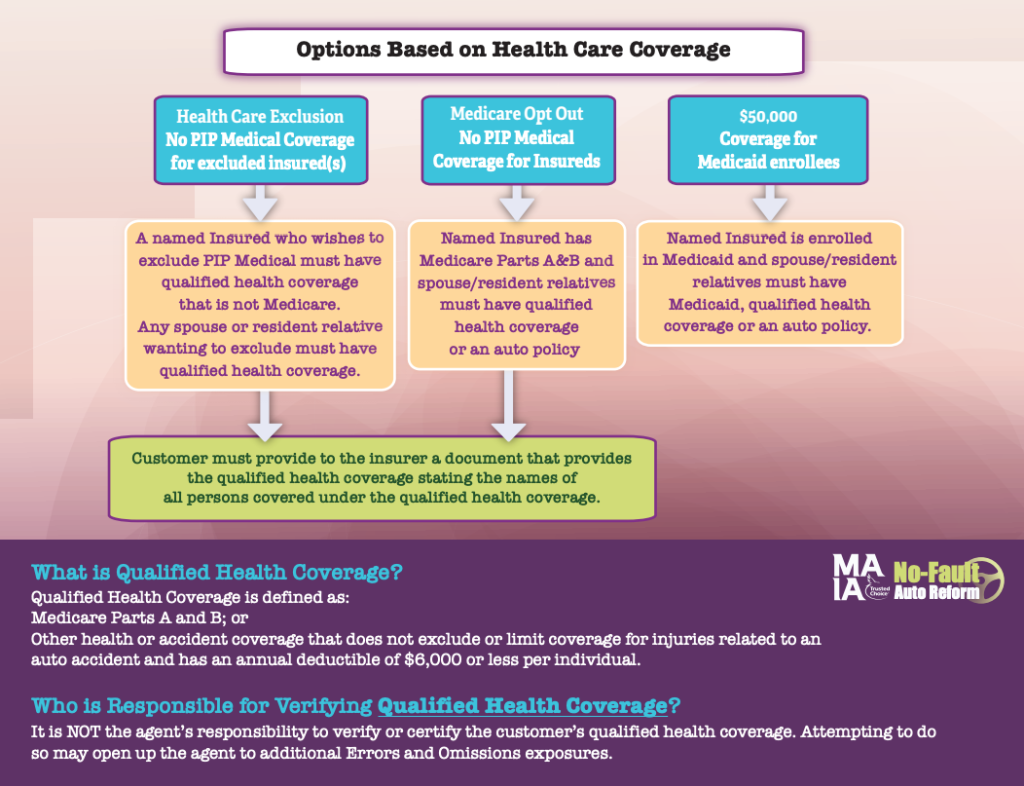

PIP Coverage Opt Out Options Based on Your Health Insurance Plan

It is important to note that you cannot opt out of PIP coverage without qualified health insurance. Your health insurance must cover auto-accident related injuries in order to opt out. Although most health insurance plans cover auto accident related injuries, some do not. If you are unsure, it is important to check with your health insurance provider. Medicaid is an exception to this rule. Even though Medicaid does cover auto accident related injuries, you are unable to opt out of PIP coverage under that policy. But, you are able to lower your coverage your coverage to $50,000 which will be very inexpensive.

If you wish to opt out of PIP coverage, you must do so for each person insured under the policy individually. Meaning, you would need qualified health coverage for every insured under your policy to exclude each of them.

Primary Versus Excess PIP Medical Coverage

Regardless of the level of PIP you choose, you must decide between a primary or excess policy. The main differences between the two are:

- Primary: auto insurance company pays first; health insurance company pays second

- Excess: health insurance company pays first; auto insurance company pays for what they won’t cover

Insurance advisors typically recommend primary coverage. When your health insurance covers something, they often will not cover the full cost, so you’ll still be subject to copays and deductibles. When the auto company pays first, it is likely that your health insurance company will not need to pay for anything at all, and you won’t be subject to those copays and deductibles.

On the other hand, some people choose excess coverage because you will get a significant discount on your insurance plan. But you are only getting a discount because the auto insurance company will save money if your health insurance company covers most of your expenses.

Did Drivers Always Choose Their Amount of PIP Coverage in Michigan?

Drivers in Michigan did not always have the option to choose the amount of PIP coverage on their auto insurance plan. Prior to July 1st, 2020, all drivers had to have unlimited PIP coverage on their auto insurance plan. Without needing to think about it, the cost of unlimited PIP was already part of your coverage.

Why Change the PIP Law?

For many years there has been controversy surrounding auto insurance laws in Michigan. Many people do not agree with no-fault laws or wish to lift requirements on insurance coverage. Allowing people to choose the amount of PIP coverage they carry is a way of giving them some freedom over how much insurance they carry. The idea is that it could save people some money who are struggling to afford insurance, and don’t think they need it. Unfortunately, choosing a lower amount of PIP coverage or opting out of the coverage does not save people as much money as they thought it would.

Legal Complications Caused by New PIP and Health Insurance Law

Allowing people to have freedom over their coverage doesn’t sound like it would cause any issues. But unfortunately, the law change left a legal hole causing some confusion among consumers. When you choose to depend on your health insurance for auto related injuries, it rarely covers all the costs leaving people with expensive bills they cannot afford. Previously, no individual could legally drive without PIP medical coverage (since everyone had unlimited PIP through their auto insurance). This meant that after an auto accident, you could not sue or be sued for unreimbursed medical bills. Now, individuals without PIP coverage can sue you for their unpaid medical bills. They can sue you even if you have PIP coverage, and if you were not at fault!

What Happens if You Are Sued?

With auto insurance, you are covered through your bodily injury liability for up to your chosen amount. There is a minimum of $50,000 per person and $100,000 per accident. But the state of Michigan recommends a minimum of $250,000 per person and $500,000 per accident. You can carry even more coverage, but most insurance companies tap out at $1,000,000 per person $1,000,000 per accident. If two people sue you after the same accident, you are covered for X dollars per person and up to X dollars per accident.

If you are sued for more than what you’re covered for, it’s up to you to pay off the rest unless you also have an umbrella insurance policy. Umbrella insurance covers you if you are found negligent or liable for someone else’s bodily injury or death. Due to Michigan’s no-fault auto law, you will be liable for unpaid medical bills regardless of fault. Without enough bodily injury liability or an umbrella insurance policy, the cost will come from your pocket.

Before the PIP law changed, people could only sue or be sued for pain and suffering. Now that you can be sued for medical bills on top of that, not having enough bodily injury liability is an issue. Previously, the standard coverage was enough. Since most people do not have an umbrella policy, people have greater liability risk on the road. This unfortunately puts most people at risk of bankruptcy every time they drive.

What is the Michigan Catastrophic Claims Association Fee (MCCA)?

You may have noticed the flow chart referenced a Michigan catastrophic claims fee. Prior to the law change on July 1st, 2020, everyone had to pay this annual fee with their auto insurance. Everyone’s fee went into a fund used to cover ‘catastrophic claims’ that exceed a certain amount within a year. “In 2021 that amount is $600,000. If an individual’s claim exceeds that in a 12-month period, then the excess amount will be covered by the MCCA fund, to be issued to the applicable insurance company.”

Not everyone is subject to this fee after the PIP law reform. The second highest amount of PIP coverage you can choose is $500,000. But, a claim must reach a $600,000 threshold to be considered a catastrophic claim. Because the insurance company can only tap into the fund for catastrophic claims, only people with unlimited PIP coverage must pay this annual fee.

Do I Need Both PIP Coverage and Health Insurance?

In summary, we recommend that everyone has both PIP coverage and health insurance. The two coverages are different, but both are necessary for your wellbeing. PIP insurance will pay for any type of medical bills, assistance, care, or rehabilitation costs after an auto injury. Health insurance will only pay for your medical bills, and you will still be subject to copays and deductibles, which often adds up to a lot of money. If you are in a bad accident, or a catastrophic accident it is very unlikely you’ll be able to afford your bills or any assistance you need to recover.

TDA Insurance & Financial Agency

TDA Insurance & Financial is an independent insurance agency located in the heart of Walled Lake, Michigan. As a family-owned business, we take pride in protecting our clients like family. As Michigan residents, all of our agents are knowledgeable on the new PIP no-fault auto insurance law. We are more than happy to answer any questions or concerns you may have regarding the law or your coverage.

We are committed to keeping you covered, and within your budget. Staying protected is important, which is why we make sure our clients can afford their coverage. We will compare your rates with over a dozen different insurance carriers to find you the best option.

Visit our website or contact a TDA agent today for a FREE quote!

Contact a TDA agent today with any questions or concerns you may have!