Watch for an in depth explanation about why your insurance rates are going up:

Why are Property and Auto Insurance Rates Rising So Much?

Recently, insurance rates have been increasing significantly due to hard market conditions. This hard insurance market is caused by high inflation, supply chain issues, an increase in severe storms, and an increase in auto accidents and liability claims.

These problems have only gotten worse since the Covid-19 pandemic. Insurance companies did not react quick enough to adjust to the increased cost of paying out claims and it cost them. Over the past few years, the cost of claims exceeded the premiums they have been bringing in.

Insurance companies typically adjust rates for slight increases in materials due to inflation over time. But those annual adjustments were not nearly enough to make up for the extreme rise in claims and inflation.

Because insurance companies are paying out more in claims than they are bringing in with premiums, they are losing money. Insurance companies now must make up for the money they have already lost, while accounting for the increased repair costs at the same time.

General Inflation on Property and Homeowner’s Insurance

Even before the pandemic, insurance companies had to account for increases in inflation. This is often called the inflation guard factor. Normal inflation guard factor causes a 2-4% increase in home insurance rates.

Homeowner’s and property insurance policies must account for the money it would cost to rebuild your property from scratch with the same materials. This cost is referred to as dwelling amount/limit/coverage. The dwelling limit rises with inflation as the cost of rebuilding your property becomes more expensive. If your rates never increased in price to account for the inflation guard factor, your entire house/property may not be covered by the insurance.

How Much are Property Insurance Rates Going Up in 2023?

This year, the normal inflation guard factor is not nearly enough to cover dwelling limits. Material and labor costs have increased much more than in pervious years. To cover the dwelling amount this year, 8-12% increases are being applied to property insurance policies.

Where are Insurance Companies Losing Money on Property Insurance Policies?

Property and Homeowners:

Increased price of materials is not the only reason for expensive homeowner repairs. The time it takes to construct repairs has also increased dramatically due to lack of materials from supply chain shortages. Labor shortages and increased labor costs are also driving repair costs up. Additionally, the cost of covering property losses after large fires has increased significantly due to additional electronic devices in the homes.

2023 Home Inflation Statistics (statistics from Citizens Insurance):

- 26% increase in building materials

- 88% of firms experiencing project delays

- 89% of contractors having difficulty finding workers

- 94% of fortune 100 companies report supply chain disruptions

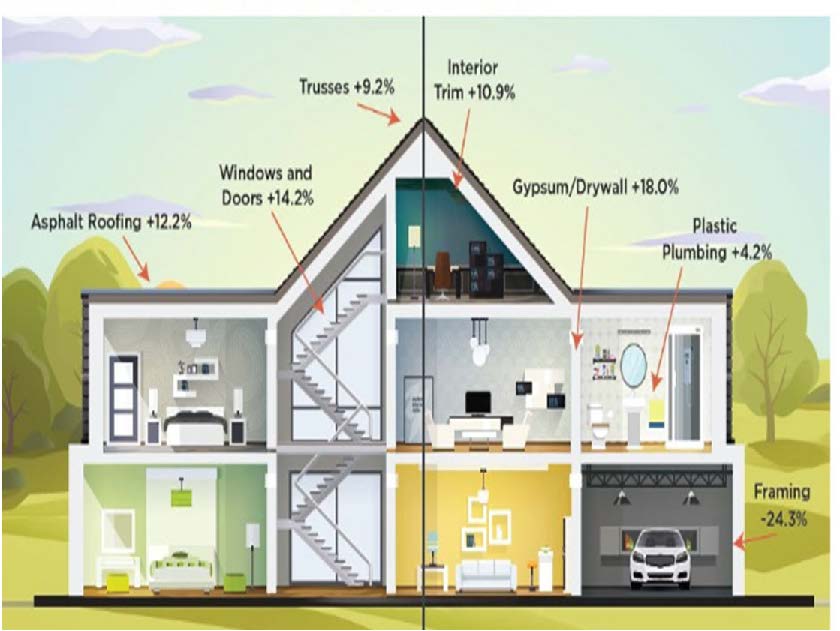

Which Materials are Increasing in Price, and by how much?

General Inflation on Auto Insurance

Like inflation on homeowners’ insurance, auto insurance rates increase gradually over time to account for inflation as well. The chip shortage in the supply chains have lengthened the cost and time to repair vehicles when they are in an accident. On top of the liability exposure for Michigan drivers increased significantly when they opened up the exposure of being able to sue for unreimbursed medical bills, now that people can opt out of the unlimited PIP medical coverage. This has caused a significant increase of the cost of auto liability claims in Michigan.

It is a good reminder that auto insurance covers much more than just the car itself, it also covers things such as bodily injury, property damage, rental reimbursement, etc. Reference one of our older blog posts for more information about everything auto insurance covers. This year, inflation and many other factors have caused these expenses to increase their rates.

Where are Insurance Companies Losing Money on Auto Insurance Policies?

Auto Insurance:

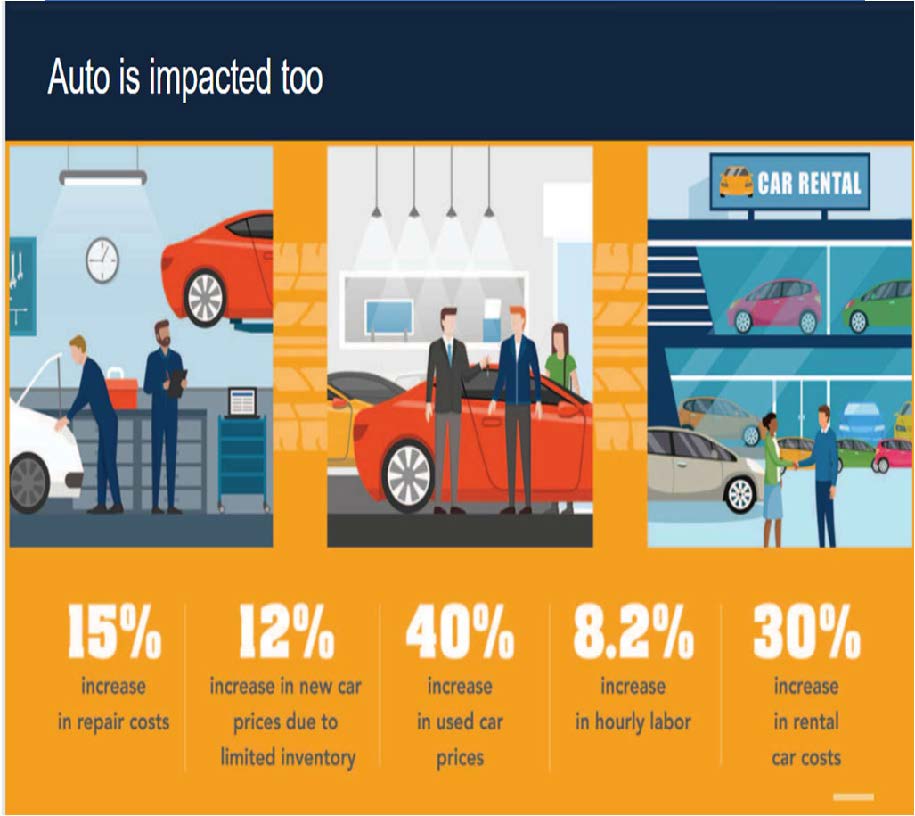

Inflation, severe weather, and increased material and labor costs affect the cost of auto repairs and auto insurance rates. Supply chain issues have caused a severe shortage of new vehicles and car parts. Auto repair shops have been experiencing shortages in car parts causing delays in repairs, and/or long wait times to get an appointment. This in turn increased the demand for used vehicles and rental cars. On top of that, drivers have been getting into more accidents and have been making more claims. The severity of the car accidents many drivers are getting into is also rising. Costly claims, and an increase in labor and material costs have caused insurance companies to be paying more money out in claims than they make back in premiums.

What is Impacting your Auto Insurance Rates?

- Claim severity

- 7% increase in auto fatalities from 2021-2022

- 26% increase in auto fatalities per 100 miles from 2009-2019

- Auto costs 2020-2022

- 18.5% increase in price of new vehicles

- 42.2% increase in price of used vehicles

- 43.2% increase price of rental cars

- 20.4% increase in cost of car parts

- 15% increase in repair costs

- 8.2% increase in labor costs

- Severe weather

- More than $1 billion is spent on auto damages each year

- Rising medical costs

- 5% overall increase in medical costs October 2021-October 2022

- 3.4% increase in cost of hospital and related services

- 1.5% increase in cost of physician services

- 5.1% increase in cost of medical equipment and supplies

- Distracted driving

- “800,000 drivers are using a device at this moment”

- In 2019 there were 3,100 deaths and 424,000 injuries due to distracted driving

Insurance Rates are Going Up Due to the Increased MCCA Fee

MCCA is short for The Michigan Catastrophic Claims Association. Insurance companies pass this cost to policyholders as part of their auto-owners insurance policy or as part of the PIP portion of their insurance policy. This fee accounts for health care costs after injuries due to auto-accidents. Because the cost of healthcare services have increased and the chances of fatal auto-accidents is on the rise, the MCCA fee must rise to pay for these costs.

The MCCA Fee Increased on July second, 2023. Unlimited PIP increased from $86 to $122 per vehicle. Since July 2020, unlimited PIP was no longer required in the state of Michigan. Instead, policyholders have options for how much PIP coverage they prefer to carry including unlimited, up to $500k, up to $250k, or they can opt out of PIP coverage completely. Opting out of PIP coverage was originally $0, but now increased to $48 per vehicle.

Independent Insurance Agencies Keep you Covered While Saving you Money

Despite hardened market conditions, there is still action that you can take to combat the rising prices. If you work with an independent insurance agent, they can compare your coverage with a variety of companies to get you the best possible rate while keeping the coverage you need. We can also implement risk controls like water detection devices, security cameras, fire protection systems, and more.

On the other hand, captive agents who represent a single insurance company will only give you insurance rates at that company, even if you could get better coverage and cheaper rates somewhere else.

A good independent insurance agent will always look out for your best interests and work within your budget.

A Good Independent Insurance Agent Will:

- Continue to shop around for you when renewal comes up

- Make sure that you’re only paying for the coverage you need

- Find additional discounts to apply to your policy (association, occupation, student, etc.)

- Adjust deductibles, coverage forms and limits to work within your budget

- Get all your insurance policies under one carrier (because multi-insurance discounts are the biggest discounts)

- Give you useful insurance and financial advice to help you stay covered

- Give you useful insurance and financial advice to help you lower your rates in the future

- Walk you through what is covered under your policies and how they differ from similar policies at other companies so you can make informed decisions about your coverage

- Be understanding of your situation and cater to your unique needs

- Thoroughly answer any of your questions and concerns

Will I Save Money Buying Insurance Online?

In recent years, many people have been trying to cut out the middlemen, using neither a captive agent nor an independent agent. This can occasionally save people money with insurance companies who offer a lower premium when buying their policy directly through their website.

But typically, working with an independent agent still results in saving time and money. Without the proper license, knowledge, and software that an agency has, trying to research which company will save you the most money would be exhausting, and nearly impossible. Money saved through a lower premium may not equate to the amount of money you will save with another company or there could be important coverages missing that you were unaware of.

Myths About Independent Insurance Agencies

A common misconception about independent agencies is that they never carry any of the large, well-known insurance brands. Although some smaller agencies only carry a few smaller companies, many carry a large variety of insurance companies including well-known brands such as AAA, Progressive, Travelers, CNA, Cincinnati, and many other A+ rated insurance carriers.

Furthermore, large insurance companies do not always have the best rates. Often, clients end up getting the best deals at some of the small, local insurance companies. Local insurance companies often give better financial and insurance advice to their clients since they have a better understanding of their state’s specific laws, regulations, and needs.

TDA Insurance & Financial Agency of Michigan

TDA is a family-owned, independent insurance agency located in the heart of Walled Lake, Michigan. Our motto is to treat our employees like family, so they treat our clients like family. For 25 years at TDA Insurance & Financial, we have taken pride in protecting our clients like family.

At TDA we understand how hard it can be to find proper coverage at affordable prices, especially now as insurance rates skyrocket. But our team is devoted to keeping you protected, and within your budget.

What can TDA do for you?

When you contact one of our dedicated account managers, they will work with you to verify discounts and make cost-saving adjustments to your policy.

A TDA account manager will look for additional discounts that may be available and review your policy to make sure you only have the coverage you need. They will adjust deductibles, coverage forms and limits to work within your budget. And they will shop you with over a dozen carriers when necessary to look for a better premium.

Unfortunately, this is not always effective when all companies have increasing rates. But, even if an agent cannot get your rate as low as it once was, it is likely that they will get your rate lower than it was prior to working with TDA Insurance.

Fill out a quote on our website or click here to contact a TDA agent to start saving money on what you’re already paying for!